LOS ANGELES | February 3rd, 2022 — 2021 was a record year for deals in video gaming, with $85B of value disclosed in over 1,159 announced or closed deals, up almost 3x compared to 2020 (Drake Star Global Gaming Report 2021). We believe this is only the beginning of a historical era of both consolidation and diversification in the industry, and given the early signs, we might see deal volume of over $150B in deals 2022.

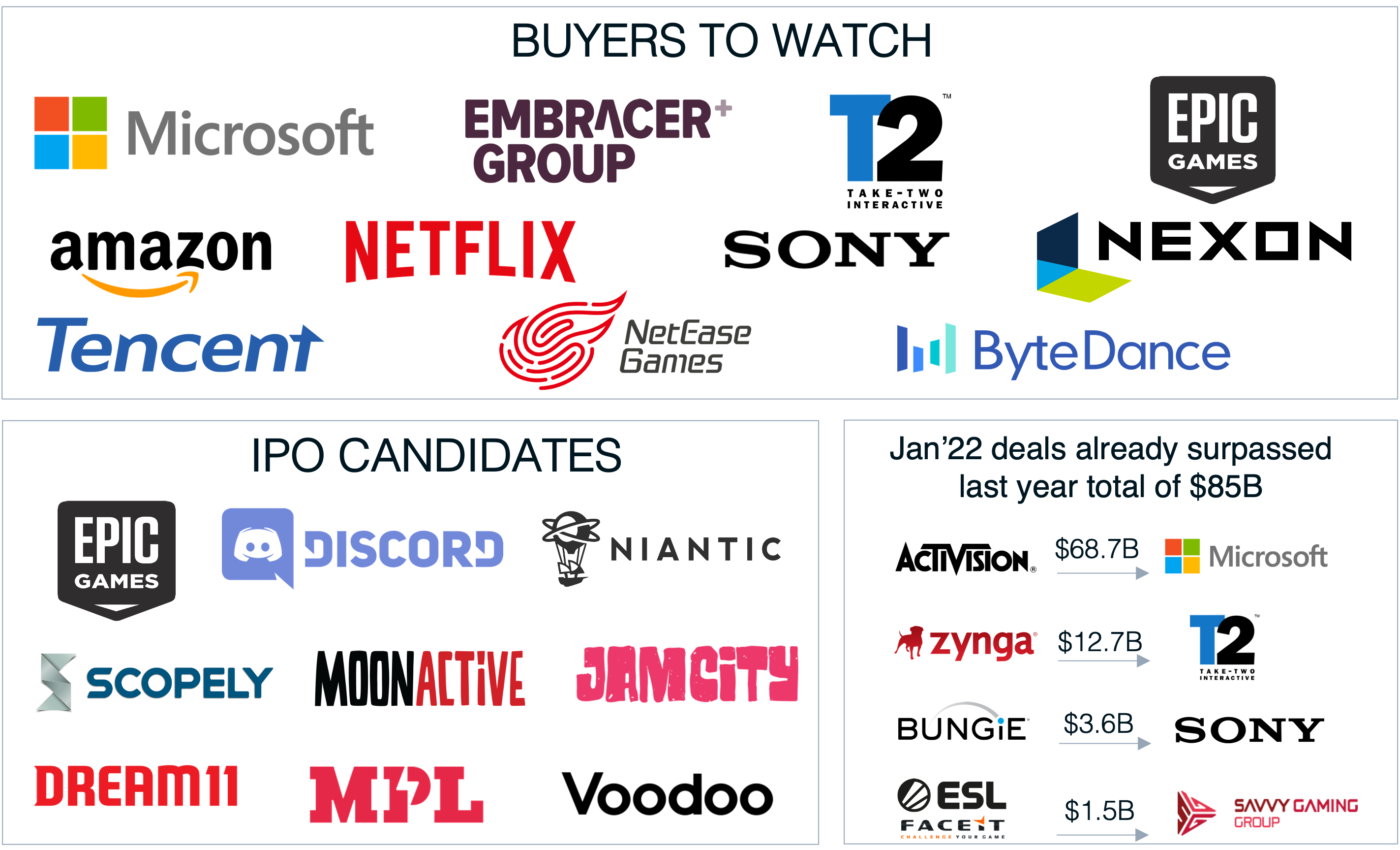

The year has already started with a bang with two proposed mega-deals: Take-Two's $12.7B acquisition of Zynga, and Microsoft's proposed $68.7B takeover of Activision Blizzard.

Accelerating Consolidation among PC / Console and Mobile, Asian and Western Players

The video gaming M&A market will be pushed ahead on several fronts. Video gaming companies that have historically focused on the PC / console segment are expanding and diversifying into mobile, and mobile-focused players are acquiring PC / console-focused companies, so the lines are blurring. Furthermore, we will see more true cross-platform games across PC / console and mobile in the years to come, and having development and live-operations expertise in all segments will become increasingly important.

Take-Two has historically focused on the PC / console segments, with mega franchises like Grand Theft Auto, but has expanded into mobile with several smaller acquisitions (Social Point, Two Dots, and Nordeus). The $12.7B acquisition of Zynga makes Take-Two a major player in mobile gaming and also diversifies its revenue. On the other side, Tencent — the biggest global player in the mobile gaming segments — has been heavily expanding into the PC / console space, with 11 acquisitions in 2021 (Sumo Group, Turtle Rock and Klei Entertainment, etc.), and we expect the company to continue acquiring many AAA PC / console developers this year.

Acquisition of western studios by Asian players will accelerate in 2022. Japan-based Sony acquired 6 gaming companies in 2021 (Housemarque, Spitfire, etc.) and Korea-based Krafton (which went public through its high-profile IPO in 2021) acquired Unknown Worlds and made strategic investments in several gaming companies. The increasingly challenging regulatory environment in China, which is restricting content, playtime, and monetization strategies, is accelerating both M&A and minority investment in western companies as Asian strategics are trying to find further growth. We expect to see continued consolidation this year from Tencent, Sony, Netease, ByteDance, Krafton, and Nexon.

Several western players acquired Asian studios, either to get access to Asian players or to content that is successful in the west. Sweden-based Stillfront just acquired 6Wave (focused on Japan) and Zynga acquired Golf Rivals / StarLark based in China.

Top western acquirers to watch this year are Embracer, EPIC, Amazon, and Netflix.

As the gaming industry consolidates, the resulting companies will also look for new revenue streams that harmonize with their existing audiences and core competencies. Companies traditionally focused on creating mobile games will likely see that the broader mobile entertainment space is ripe for expansion. Dating, meditation, and lifestyle apps can be seen as a similar type of content as games that require expertise in acquiring, retaining, and monetizing mobile users. Expect successful brands to add new mobile entertainment verticals to their portfolios.

New Wave of Unicorns

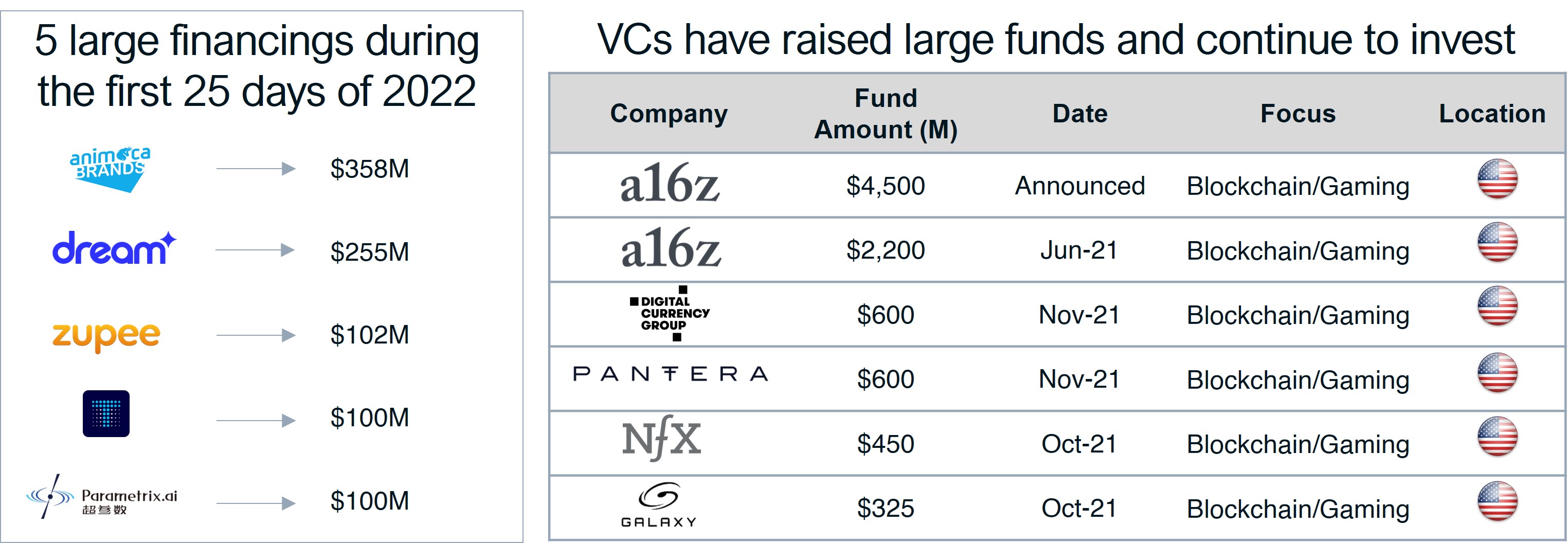

Investments in private companies reached a record $13B in over 700 deals in 2021. There were 9 disclosed large investments in promising developers that were at or above $100M amount in 2021 alone and a dozen similar large funding rounds in gaming platforms and hardware category. The capital invested in private companies steadily increased from Q1’21 to Q4’21 and reached a record of $4.1B with over 200 deals in Q4’21 alone. At the same time, numerous new funds were formed in 2021, and they will likely put all this money to work this year to take part in the industry-wide growth. We expect 2022 to reach a new record in both deal value and volume of gaming private placements and numerous financing round at or above unicorn level. Investments will come from both VCs as well as strategic investors, such as Tencent, Netease, and Warner Music.

High-Profile IPOs

We are excited to see several high-profile IPOs in 2022, such as EPIC Games and Discord, two companies that are in the midst of multi-industry expansions and eager to capitalize on the growth potential they signify. There is also a growing list of companies that have reached an IPO-ready stage, such as Niantic, Scopely, Voodoo, Jam City, Moon Active, Dream11, and MPL and some of them may decide to go public this year.

2021 was a banner year for IPOs, direct listings, and SPACs, including Roblox, Krafton, Unity, IronSource, AppLovin, Playtika, Playstudios, Nexters, Skillz, and Devolver. That optimism for gaming SPAC deals has cooled as deals fell through during the later part of 2021, some SPACs did not perform well and traditional IPOs and direct listings proved effective. However, with an expectation of an overall market rebound in 2022, we expect to see some gaming companies going public via SPACs as SPACs aggressively look to find targets.

Return of VR/AR

There is already renewed interest in the VR/AR space in what could be considered its second cycle (the first being the initial rush around 2017) and one far less likely to implode.

The new interest is partly driven by the promise of the metaverse. The interest paid by Facebook in its rebranding to Meta and pivot to supporting the metaverse has also prompted new speculation in the VC community.

Support from Meta promises a healthy ecosystem in the near and medium-term, reducing the risk that a startup will be starved for infrastructure and potential customers. Business models that faltered years ago may be resurrected in an environment more conducive to them, and with valuable insights from their predecessors.

The hardware front is promising as well, with new headsets achieving levels of both quality and affordability that far exceed the previous generations. Sony has detailed its PSVR2 headset, likely to be in as constant demand as its PS5 console, while low-end competitors like Google have been pushed out of the way by affordable standalone headsets like the Oculus Quest — itself due to be succeeded soon. Meta CEO Mark Zuckerberg has also confirmed that the company subsidizes and will continue to subsidize the cost of its headsets.

Subscription Battleground

The subscription business is fast becoming one of the most contested in the gaming world. What began as access to certain premium online features has become a battleground for crucial recurring revenue.

Sony has slowly increased the perks and free games available via its PlayStation Plus membership program, but Microsoft has invested far more heavily, clearly seeing an opportunity to pass up its rival by pressing its advantage in the PC market. Over the last year, its Xbox Game Pass subscription has become a huge value proposition for gamers on both PC and Xbox platforms, with dozens of free games and features rolled in from other subscriptions like Xbox Live Gold.

The company just announced that it has reached 25 million players paying for Game Pass — and Sony is working on a new and improved subscription service code named Spartacus that is expected to launch in the spring of 2022. Even Nintendo, which rarely takes its cues from the broader gaming industry, has begun expanding its comparatively barebones Nintendo Switch Online service.

Microsoft's acquisition of Activision Blizzard could put several of the world's most popular gaming franchises at their disposal for Game Pass inclusion or discounts. We would not be surprised if Sony responds to the Activision Blizzard acquisition with attractive offers to acquire other top-listed PC / console gaming companies.

NFTs and Beyond

There will continue to be heavy investment in the NFT and blockchain gaming space driven by both strategic investors like Animoca (invested in 52 gaming companies in 2021) and VCs like Andreessen Horowitz (rumored to be raising a $4.5B crypto fund). 2022 is expected to significantly exceed last year’s investments of $3.6B and we will likely see many new NFT unicorns among young gaming companies.

We will see the first wave of highly successful games with a play-to-earn economy beyond Axie Infinity. Broader adoption of NFT based gaming will probably take many years, and 2022 will likely also bring the first wave of losers among the NFT focused startups. We believe that the established top gaming buyers will carefully watch the NFT gaming and the associated regulatory environment to unfold before making any major acquisitions in the space.

Drake Star Gaming Team:

Michael Metzger, Mohit Pareek

Inquiries

For further inquiries, please contact:

Michael Metzger

Partner

michael.metzger@drakestar.com